child tax credit december 2021 how much will i get

How much is the 2021 child tax credit. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the.

Itf 12c Pdf Expense Taxes Word Doc Taxact Self Assessment

It is not clear whether or not the.

. An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit. MILLIONS of Americans are set to get their final monthly child tax credit payment in December under President Joe Bidens American Rescue PlanThe p. Enter your information on Schedule 8812 Form.

957 ET Dec 15 2021. However the deadline to apply for the child. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000. How much is it and when will I get it. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

Additionally the trillion-dollar stimulus bill. While you can get 3600 for every child under the age of six. For each qualifying child age 5 or younger an eligible individual generally received 300 each month.

You would be eligible to receive 1800 in 2021 and 1800 when you file your tax return. Child tax credit 2021. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17.

If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. Most taxpayers have previously been able to reduce their federal income tax bill by up to 2000 per child. How much is it and when will I get it.

Get your advance payments total and number of qualifying children in your online account. The current credit is worth 3600 for each child under six and 3000 for those between six and seventeen. Check mailed to a foreign address.

841 ET Dec 15 2021. Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible increased from 2000 per child to 3600. The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24.

To reconcile advance payments on your 2021 return. 841 ET Dec 15 2021. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only. 2021 child tax credit maximum payments Age 5 and younger Up to 3600 with half as 300 advance monthly payments. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

2021 child tax credit maximum payments Age 5 and younger Up to 3600 with half as 300 advance monthly payments. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older one. Will i get the child tax credit if i have a baby in december.

Invalid Date MILLIONS of Americans are set to get their final monthly child tax credit payment in December under President Joe Bidens. 957 ET Dec 15 2021. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000.

However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income limits see the FAQs below. Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their.

Jump directly to the content. At first glance the steps to request a payment trace can look daunting. However theyre automatically issued as monthly advance payments between July and December -.

Among other changes the CTC was increased this year from 2000 per child to as much as 3600 per child as well as extended for the. Lets say you qualified for the full 3600 child tax credit in 2021. Child tax credit 2021.

This amount was then divided into monthly advance payments. The full credit is available for heads of households earning up to 112500 a year. The expanded child tax credit provides up to 3600 for each child age 5 and under and up to 3000 for each child age 6-17 with half payable in six monthly installments of.

People Have Already Received Their 300 Per Child Tax Payment Here S How To Check On Yours

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

2020 Reverse Tax Credit Available For Filing Barbados Today In 2021 Tax Credits Reverse Tax

Thinking About Going Solar This Year And Heard About The 30 Itc Learn What It Actually Is Hint It S Not An Income Tax Credit Solar Solar Energy Alternative Energy

2021 Child Tax Credit Advanced Payment Option Tas

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit 2022 Who Has Been Most Affected By The End Of Payments As Com

Always Keep Employee Td1 S Up To Date Tax Credits Hiring Employees New Bus

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

What Families Need To Know About The Ctc In 2022 Clasp

Parents Guide To The Child Tax Credit Nextadvisor With Time

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

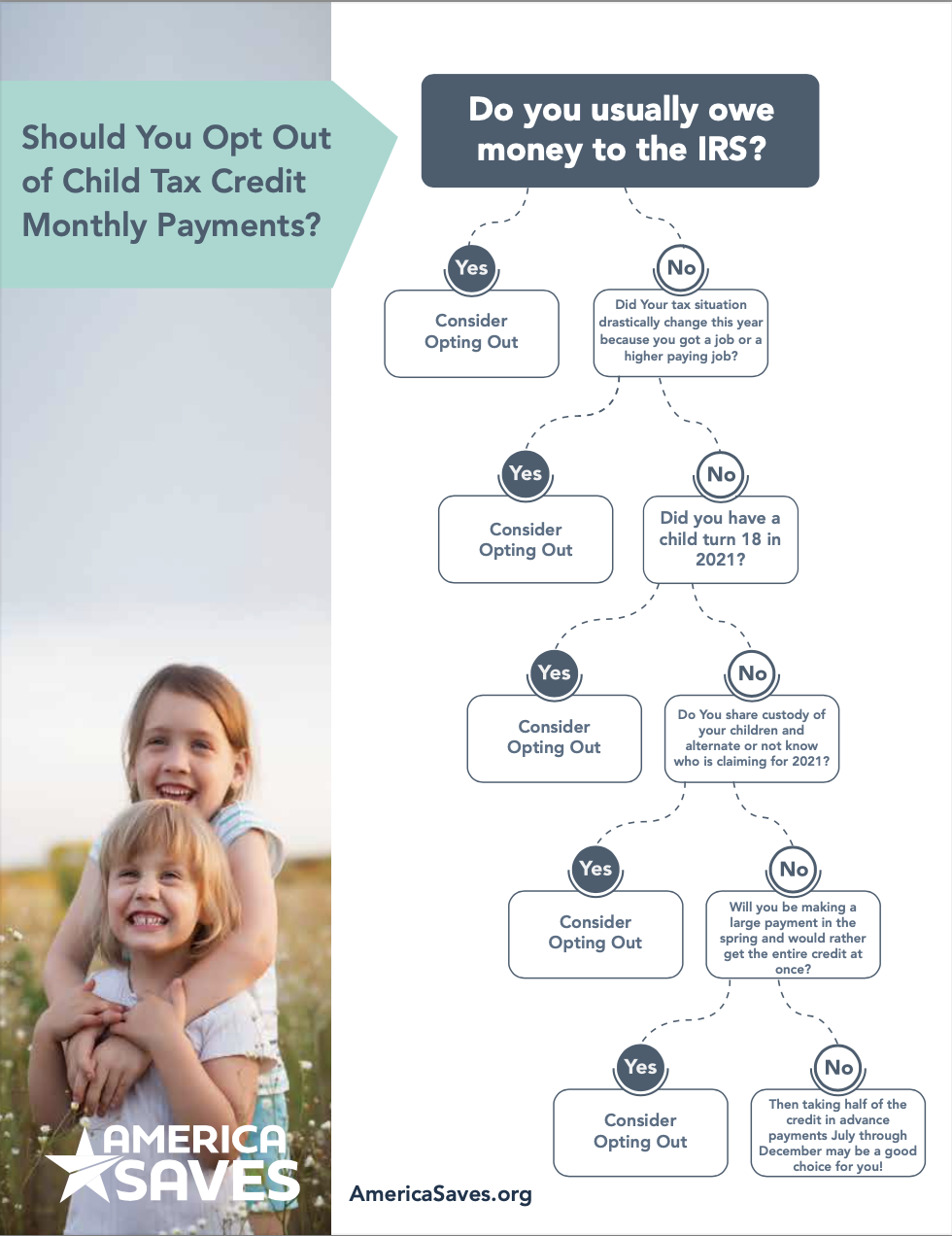

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities